- Services

Import Customs Clearance

Import of Goods

Import Customs Clearance, How It Works?

Import of Goods – Restrictions

There are many restrictions on importing goods but these can be divided into two categories:- Tariff – Clauses and tariff quotas allow imports of a certain quantity of a product at a lower import duty rate (quota duty rate) than the duty generally applied to that product.

- Non-tariff – Quantitative restrictions, import taxes, import surveillance, levies, technical standards, sanitary and veterinary requirements that goods must meet to enter a given market

Import Customs Clearance in the UK: Declarations and Requirements

Whether you’re a small business owner or a large corporation, ensuring your goods clear customs efficiently and compliantly is crucial for the success of your operations.

The customs clearance process in the UK is designed to ensure the smooth and secure movement of goods across the country’s borders. This process involves a series of steps that must be completed to comply with the UK’s import regulations and ensure your goods are cleared for entry.

As an importer, it’s crucial to familiarize yourself with the customs clearance process to avoid delays, additional costs, or potential penalties.

When importing goods into the UK, there are certain items that must be declared to customs. These include:

- Commercial Goods: Any goods that are being imported for commercial purposes, such as resale or business use, must be declared to customs.

- Personal Goods: Individuals importing personal items, such as gifts or household items, may also need to declare them to customs, depending on the value and nature of the goods.

- Restricted or Prohibited Items: Certain goods, such as firearms, drugs, or endangered species, are either restricted or prohibited from being imported into the UK. These items must be declared and may require additional documentation or permits.

- Goods Subject to Duties or Taxes: Imported goods may be subject to customs duties, excise taxes, or value-added tax (VAT). These charges must be declared and paid to customs before the goods can be cleared for entry.

It’s important to thoroughly research the specific items you are importing and their customs requirements to ensure compliance and a smooth clearance process.

Step 1: Obtaining an EORI Number

The first step in the import customs clearance process in the UK is to obtain an Economic Operator Registration and Identification (EORI) number. This unique identifier is required for all businesses and individuals engaged in the movement of goods across the UK’s borders.

To obtain an EORI number, you can apply online through the UK government’s website. The process is straightforward and typically takes a few days to complete. Once you have your EORI number, you’ll be able to use it for all your future import and export activities.

Step 2: Classifying Your Goods

After obtaining your EORI number, the next step is to classify your goods. This involves determining the correct commodity code for your imported items, which is essential for calculating the appropriate customs duties and taxes.

The UK uses the Combined Nomenclature (CN) system to classify goods for customs purposes. This system provides a detailed classification structure, and it’s important to ensure you accurately identify the correct code for your goods. You can use the UK Trade Tariff tool to search for the appropriate commodity code.

Step 3: Valuing Your Goods

Accurately valuing your imported goods is crucial for determining the correct customs duties and taxes. The value of your goods is typically based on the transaction value, which is the price paid or payable for the goods, including any additional costs such as transportation, insurance, and handling fees.

If the transaction value is not available or cannot be used, there are alternative methods for determining the customs value, such as the use of identical or similar goods, deductive value, or computed value. It’s essential to familiarize yourself with the various valuation methods and ensure you are providing accurate information to customs.

Step 4: Checking Whether You Need a Licence

Depending on the nature of your imported goods, you may need to obtain a specific licence or permit before they can be cleared through customs. Some common examples of goods that may require a licence include:

- Firearms and ammunition

- Controlled drugs and substances

- Endangered species and wildlife products

- Food, plants, and animal products

- Hazardous materials and chemicals

It’s your responsibility as the importer to research and obtain the necessary licences or permits before attempting to clear your goods through customs.

Step 5: Declaring Your Imports to Customs

Once you have completed the previous steps, you can proceed to declare your imports to customs. This involves submitting the required documentation, such as the commercial invoice, packing list, and any necessary licences or permits, to the UK’s customs authorities.

There are several ways to declare your imports, including:

- Electronic Customs Declaration: You can submit your customs declaration electronically through the UK’s Customs Handling of Import and Export Freight (CHIEF) system or the upcoming Customs Declaration Service (CDS).

- Customs Clearance Agent: You can hire a customs clearance agent or broker to handle the declaration process on your behalf, which can be particularly useful for complex or high-volume imports.

- Postal Declarations: For low-value goods imported via postal services, you may be able to use simplified postal declaration procedures.

Regardless of the method you choose, it’s crucial to ensure that your customs declaration is accurate and complete.

Step 6: Paying Any Duty and VAT Due

Once your goods have been declared to customs, you’ll need to pay any applicable duties and taxes before they can be released for entry into the UK. The amount of duty and VAT owed will depend on the value, classification, and origin of your goods.

You can pay the required duties and taxes online through the UK government’s payment portal or by arranging a direct debit with customs. It’s important to make these payments promptly to avoid additional charges or delays in the clearance process.

Step 7: Keeping Records for Customs

As an importer, you are required to maintain detailed records of your import activities for a minimum of four years. This includes all documentation related to your customs declarations, such as invoices, packing lists, and any licenses or permits.

Keeping accurate and organized records is essential for compliance purposes, and may be necessary in the event of a customs audit or investigation.

Common Challenges and Issues with Import Customs Clearance

While the customs clearance process in the UK is generally well-established, there are some common challenges and issues that importers may face, including:

- Incorrect or Incomplete Documentation

- Misclassification of Goods

- Lack of Necessary Licenses or Permits

- Delays: Customs clearance can sometimes be subject to delays due to high volumes of imports, staffing issues, or other factors beyond your control.

- Changes in Regulations: The UK’s import regulations and requirements are subject to periodic changes, which can catch importers off guard if they are not staying up-to-date.

To mitigate these challenges, it’s essential to stay informed, plan ahead, and consider working with a reputable customs clearance agent or broker who can help navigate the complexities of the process.

Customs clearance agents are professionals who specialize in navigating the customs clearance process on behalf of their clients. They can handle the entire process, from obtaining the necessary documentation to paying any required duties and taxes. This can be particularly beneficial for businesses that import goods on a regular basis or have complex import requirements.

Testimonials from many satisfied customers

"I appreciate your diligence, knowledge and professionalism in handling this re-export in the right way. Brokers like you are like gold. It has been a pure pleasure to work with you."

John Doe

Codetic

"We are delighted to finally be able to give you more business! You are the only decent broker we have come across, so the lack of service/knowledge from others is extremely frustrating."

Jane Doe

Codetic

Why choose us?

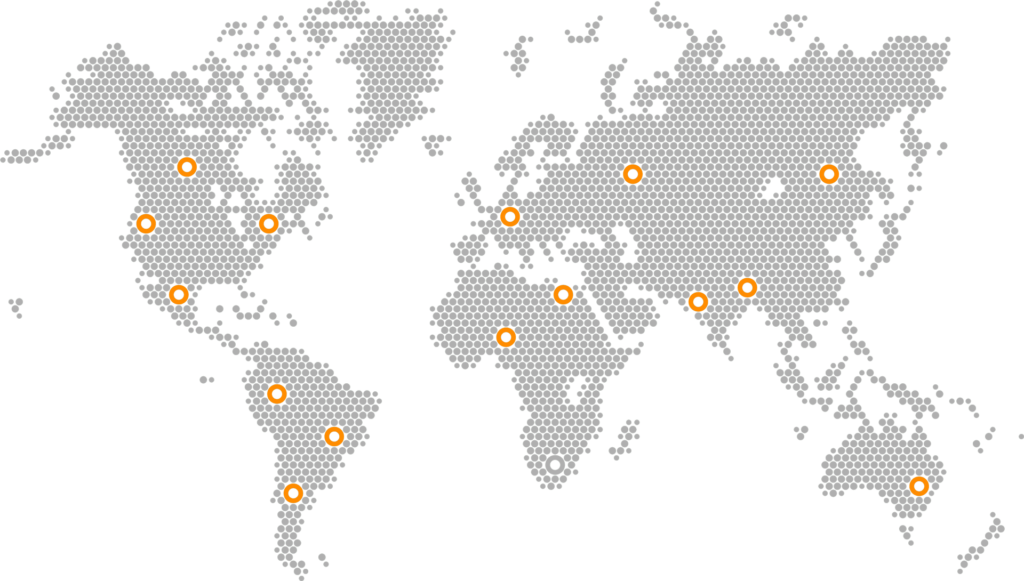

Import broker UK - We are trusted by more than 150 partners worldwide.

We will relieve you of as much work and effort as possible. Your choice of a customs agency determines the way in which the inspection will proceed. That’s why we give you comprehensive customs services for imports and exports. DCP Logistics – Import Customs Clearance Agency.

Always on time

We keep to deadlines

Affordable prices

Check it out, call us